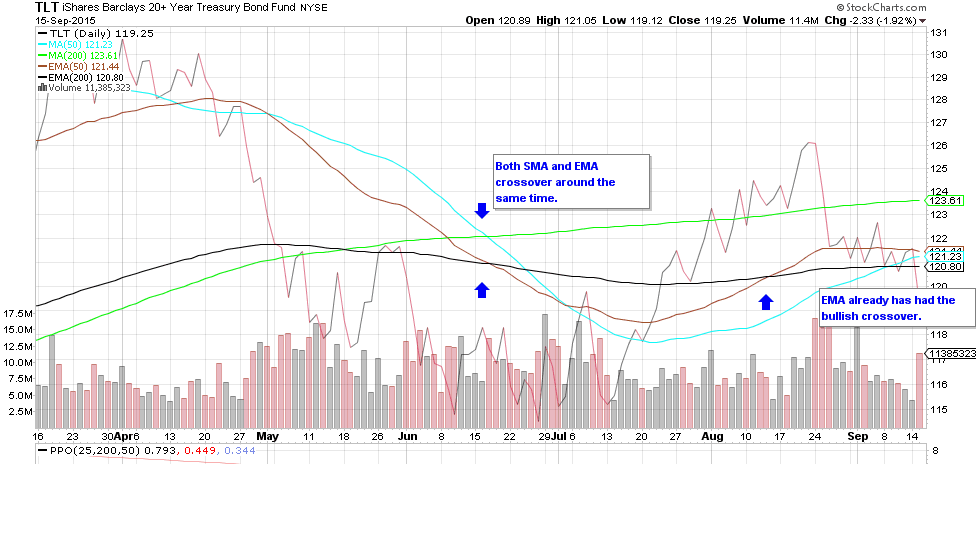

This would work well when looking at longer time frames, as it could give you an idea of the overall trend.Īlthough it is slow to respond to the price action, it could possibly save you from many fake-outs. When you want a moving average that is smoother and slower to respond to price action, then a longer period SMA is the best way to go. With a simple moving average, the opposite is true. This would be a case of the indicator being too fast for your own good. Distinguish SMA vs EMAīecause the moving average responds so quickly to the price, you might think a trend is forming when it could just be a price spike. The downside of using the exponential moving average is that you might get faked out during consolidation periods. In fact, the earlier you catch a trend, the longer you can ride it and rake in those profits. These can help you catch trends very early (more on this later), which will result in higher profit. To begin, we’ll look at the exponential moving average.Ī short period EMA is the ideal way to go if you want a moving average that will respond to the market activity rapidly. Is it better to use a simple or exponential moving average?

SMA VS EMA FREE

100% Free Download.ĭownload Free Forex Strategies and Top Rated Metatrader 4/5 Indicatorsĭownload top rated forex strategies and best MT4/MT5 forex indicators.You’re probably wondering which is superior at this point (SMA vs EMA).

Do Hammer and Shooting Star Candlestick Formations Work in Forex?.Bollinger Band Width And Trading Ranges.Trading the Nonfarm Payrolls In Forex.Forex Stop Loss? I Don't Want To Use It.Understanding Swing trading with Fibonacci Grid.If it helps your trading, then keep it and if it does not help your trading, then look to replace it. But the only judge to what type of moving average to use is your account balance from month to month. Short-term traders have made the 10-day EMA popular based on its use by some famous traders. If the market is above the 200-day SMA, the trend is considered to be up and if the market is below the SMA, the trend is considered down. The 200-day SMA is popular for identifying the trend. There is just not enough difference in the two to have that much of an impact in the results of a certain strategy. If you find that a switch from a SMA to an EMA turns a losing strategy into a winning strategy, it is probably your strategy that needs changing instead of the moving average. But the reality is that it is unlikely that one moving average will give you winning results if the other does not. New traders will play with both to find out which one is better and use that one in their trading approach.

But in this case there really is not much of a difference. Normally, the EMA will change sooner than the SMA because it emphasizes the recent activity more than the older activity. You can see that in the graphic there is little difference between the two. Below is a daily chart of the EUR/USD with a 200-day SMA (green line) and a 200-day EMA (black line) plotted. Which moving average is better, the Simple Moving Average (SMA) or the Exponential Moving Average (EMA)? This is the type of question I get every week from new traders who have found all of these new tools at their disposal and start the process of finding the best ones. Simple Moving Averages(SMA) versus Exponential Moving Averages(EMA) Written by Thomas L.

0 kommentar(er)

0 kommentar(er)